Friday, April 29, 2011

Foreign Exchange Spreads

What is Spread in Forex Trading?

Spread in Forex Trading

In the forex market, spreads are the difference between the offer prices and the bidding prices that are quoted in pips. For instance, the quote of GBP/USD is 1.8281/84 which means that the bidding price of GBP is 1.8281 US dollar while the offer price is 1.8284 US dollar. In this particular case, the spread is 3 pips.

Role of Spread in Forex Trading

Spread is an important parameter that helps brokers to make profit in forex trading. Wider spreads indicate a high offer price and a low bidding price. This simply means that you have to pay more when you buy and make fewer amounts when you sell out, this property makes the realization and estimation of profit difficult for forex traders.

Spreads & Trading Skills

The return which you get on your trading skills is greatly affected by the spreads. Being a trader, your ultimate goal is to make profit by buying low and selling high. Traders usually take a half-pip lower spread as granted, but in reality it can make an effective trading strategy into an ineffective strategy.

Spreads & Execution

You can achieve stability and success with spreads only if you work with appropriate execution. The quality of execution identifies whether you are going to get tight spreads or not. You must be aware of the denied trades, slippage, delayed execution and stop hunting which nullifies the effects of tight spread forex trade.

You must always take forex spread into consideration with the depth of the book. In most cases, forex brokers provide tight spreads only for capped trading volumes which are totally inappropriate for the traditional forex trading strategies.

What Forex Brokers Claim?

Tight Spreads

At present, almost all forex brokers claim that they are having the tightest spreads in the forex industry. However, spread terms and policies vary remarkably from one forex broker to another, besides the transactions that are not clear. Some brokers offer non-variable spreads that remain unchanged regardless of the quality of the liquidity of forex market. However, non-variable spreads are usually higher than that of the variable spreads.

Some other brokers provide variable spreads in accordance with the liquidity of market. For such brokers, spreads become tighter when the market liquidity is at good level, however, it widens when the market liquidity falls. There are various brokers who provide different spreads for different forex traders.

Forex traders who are having larger forex accounts or others, who carry out big trades, may get tighter spreads than other traders. Therefore, it is a wise idea to seek for a broker who is offering you the tightest variable spreads without any discrimination.

An Introduction to Forex Trading

One might think forex trading is a piece of cake until they enter in it seriously. Beginner forex traders must work hard to achieve real success in forex market as a beginner. Beginners must follow effective strategies; they must acquire effective money management skills and gain complete knowledge about forex trading.

Beginners Forex Lessons

If you are starting your forex trading beginners for very first time then you should take help from beginner forex lessons. This is because there is a huge traffic of forex beginner traders because of the incorporation of convenient and welcoming ways to join forex trading. Forex trading market is growing rapidly and its annual turnover is 1.9 million USD. Beginners should not take it easy. Beginner forex lessons will help forex traders to understand the buying and selling processes in forex market. In forex market, currency exchange trading occurs in pairs and at the same time buying and selling occurs.

Starters Forex

If you are starting forex trading with a starter forex then you must know about the rules of forex trading business. Particularly, you should know the basics of the buying and selling different currencies. According to recent surveys, government or companies that buy or sell their services and products daily in other countries constitute over 5% of the total profit generated in forex market. On the other hand, the remaining 95% profit is contributed by the speculation methods.

Dominant Currency Pairs

Beginner forex is a great helping tool for amateur traders. It provides them information about the perfect currency pairs that are dominating the forex trading market.

The actual dominating currency pairs in forex market are listed below.

- USD-CAD

- EUR-USD

- NZD New Zealand Dollar-USD

- USD-CHF Swiss Franc

- AUD Australian Dollar-USD

- USD-JPY

- GBP-USD

Forex Quote

Beginner forex will help you to read the forex quote. Basically, forex quote comprises of two numbers. These numbers are bid and offer. The best way to understand forex quote is to use the currency pair. For instance, consider the currency pair AUD/USD. The cost offered by the Australian dollar will act as the bidding price and it will be used by the traders as a price to buy the Australian dollar against the USD.

On the contrary, the price that is offered by the US dollar will act as the offer price and it will be used by the traders to sell the Australian dollar against the other i.e. USD. At 1 point, the base price value is taken in forex trading.

What is expected from Beginner Traders?

- Beginner forex traders must acquire right approach while working in forex trading. This is a beginner forex is all about; it helps beginners to understand the two approaches of forex trading. These two approaches include two different analysis methods. Beginner forex traders should either work with fundamental or technical analysis.

- Beginner trader should also make contact with a genuine forex pips to get effective and correct guidance.

- Beginner traders should also acquire correct risk and management skills.

Forex Pivot Point Calculators

Forex Pivot Point

Popularity of Pivot Points in Forex Market

Forex Pivot Calculator

Resistance 2 = Pivot + (R1 – S1)

Resistance 1 = 2 ´ Pivot – Low

Pivot Point = (High + Close + Low )/3

Support 1 = 2 ´ Pivot – High

Support 2 = Pivot – (R1 – S1)

Support 3 = Low – 2 ´ (High – Pivot)

Low Point: 1.2213

Close Point: 1.2249

Resistance 2 = 1.2337

Resistance 1 = 1.2293

Pivot Point = 1.2253

Support 1 = 1.2209

Support 2 = 1.2169

Support 3 = 1.2125

What does it indicate?

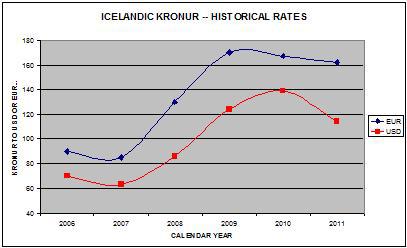

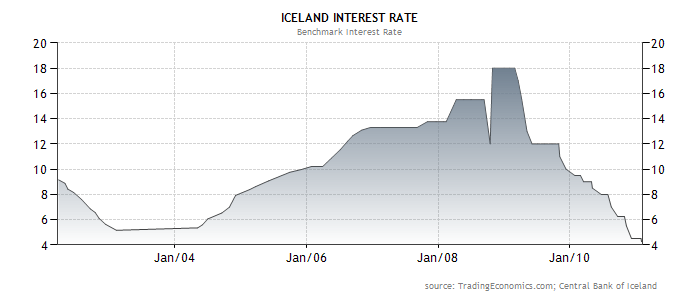

Icelandic Kronur: Lessons from a Failed Carry Trade

At its peak, nominal GDP was a relatively modest $20 Billion, sandwiched between Nepal and Turkmenistan in the global GDP rankings. Its population is only 300,000, its current account has been mired in persistent deficit, and its Central Bank boasts a mere $8 Billion in foreign exchange reserves. That being the case, why did investors flock to Iceland and not Turkmenistan?

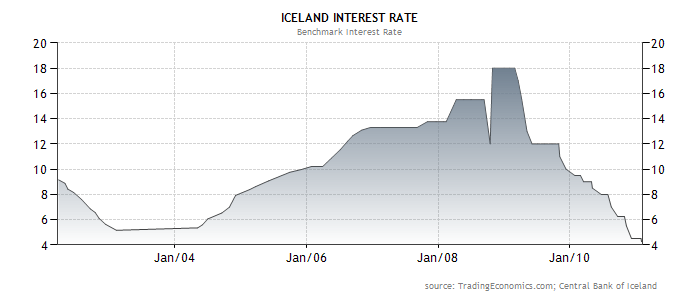

The short answer to that question is interest rates. As I said, Iceland’s benchmark interest rate exceeded 18% at its peak. There are plenty of countries that offered similarly high interest rates, but Iceland was somehow perceived as being more stable. While it didn’t apply to join the European Union (its application is still pending) until last year, Iceland has always benefited from its association with Europe in general, and Scandinavia in particular. Thanks to per capita GDP of $38,000 per person, its reputation as a stable, advanced economy was not unwarranted.

On the other hand, Iceland has always struggled with high inflation, which means its interest rates were never very high in real terms. In addition, the deregulation of its financial sector opened the door for its banks to take huge risks with deposits. Basically, depositors – many from outside the country – parked their savings in Icelandic banks, which turned around and invested the money in high-yield / high-risk ventures. When the credit crisis struck, its banks were quickly wiped out, and the government chose not to follow in the footsteps of other governments and bail them out.

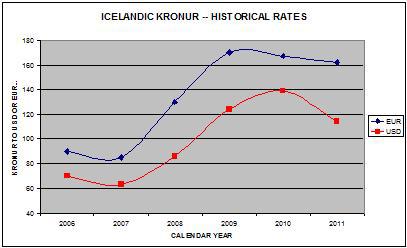

Moreover, it doesn’t look like Iceland will regain its luster any time soon. Its economy has shrunk by 40% over the last two years, and one prominent economist has estimated that it will take 7-10 years for it to fully recover. Unemployment and inflation remain high even though interest rates have been cut to 4.25% – a record low. The Kronur has lost 50% of its value against the Dollar and the Euro, the stock market has been decimated, and the recent decision to not remunerate Dutch and British insurance companies that lost money in Iceland’s crash will only serve to further spook foreign investors. In short, while the Kronur will probably recover some of its value over the next few years (aided by the possibility of joining the Euro), it probably won’t find itself on the radar screens of carry traders anytime soon.

Now that the carry trade is making a comeback, it’s probably a good time to take a step back and re-assess the risks of such a strategy. Even if Iceland proves to be an extreme case – since most countries won’t let their banks fail – traders must still acknowledge the possibility of massive currency depreciation. In other words, even if the deposits themselves are guaranteed, there is an ever-present risk that converting that deposit back into one’s home currency will result in losses. That’s especially true for a currency that is as illiquid as the Kronur (so illiquid that it took me a while to even find a reliable quote!), and is susceptible to liquidity crunches and short squeezes.

Now that the carry trade is making a comeback, it’s probably a good time to take a step back and re-assess the risks of such a strategy. Even if Iceland proves to be an extreme case – since most countries won’t let their banks fail – traders must still acknowledge the possibility of massive currency depreciation. In other words, even if the deposits themselves are guaranteed, there is an ever-present risk that converting that deposit back into one’s home currency will result in losses. That’s especially true for a currency that is as illiquid as the Kronur (so illiquid that it took me a while to even find a reliable quote!), and is susceptible to liquidity crunches and short squeezes.Wednesday, April 27, 2011

Forex Ambush

The actual signals from Forex Ambush Software translate into “pips” and, since the signals are occurring at the precise minute that Forex Ambush 2.0 trades, you must be at your pc to access these signals and act upon them – should you opt for to do so. If your mobile phone is able to support the Forex software program, you can obtain the Forex Ambush 2.0 signals on your cell phone anywhere within the world and act on the signals received.

When trading in Foreign Exchange markets (Forex), the currency will be the “pip”. Forex Ambush 2.0 supports a trailing pip of 5, but some Forex software won’t support a trailing pip of below 15. Forex Ambush 2.0 have, nevertheless, thought of this and factored it in, with “expert advisor” software program which might be installed separately. This software program was developed for MetaTrader employing a 5 pip trailing quit.

Forex Ambush 2.0 function with a 5 pip trailing profit along with a 20 pip take profit. Stop loss just isn’t utilized with Forex Ambush 2.0. Fundamentally, without having going into too much confusing detail, if the signal falls between five pips and 20 pips, Forex Ambush 2.0 advises you to trade. If it falls outside of that, Forex Ambush 2.0 advises you not to trade. Basically, the automated trailing stop as well as the take profit will close the trade for you. Forex Ambush 2.0 advises you to by no means close a trade manually – leave your Forex software program running and your pc on and Forex Ambush 2.0 Software is developed to do the rest.

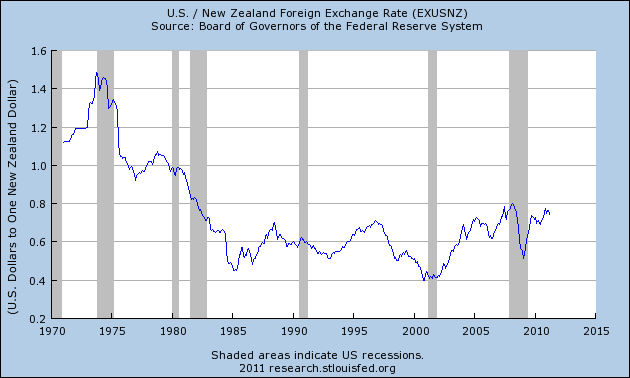

Is the Kiwi the Most Overvalued Currency?

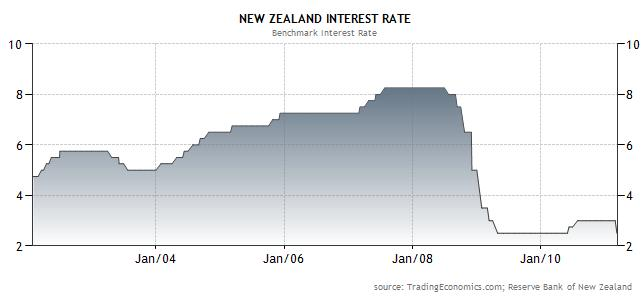

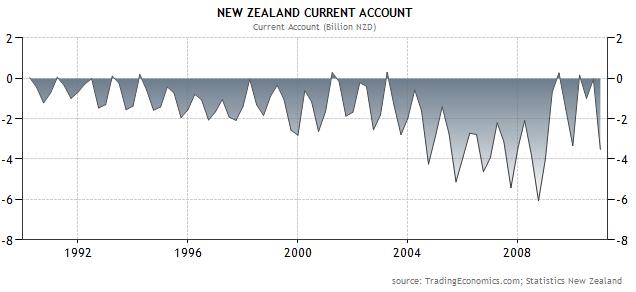

There are two principal reasons for the Kiwi’s perennial appeal with forex traders. First, New Zealand frequently boasts some of the highest interest rates in the industrialized world. Before the credit bubble burst, New Zealand’s benchmark interest rate was a whopping 8.25%. Moreover, because of its association with Australia, investors are quick to ascribe to it (dubiously) a greater sense of security than they would to emerging market economies with similarly high interest rates. For example, while Brazilian rates are usually higher, the markets less apt to lump the Real together with the Australian Dollar, even though it’s arguably a closer fit than the Kiwi.

While it’s hard to predict New Zealand trade dynamics, we can say with relative certainty real interest rate levels will remain low for the foreseeable future. Two recent earthquakes have threatened an economy that is already in trouble (projected GDP growth in 2011 is only 1.3%). Over the next 12 months, the markets have priced in only 50 basis points in rate hikes. “Nothing here will change the RBNZ’s intentions to keep monetary policy at ‘emergency’ levels for the rest of this year,” summarized one analyst. Meanwhile, the CPI rate is currently at 4.5%, and is generally tracking commodities prices higher.

While it’s hard to predict New Zealand trade dynamics, we can say with relative certainty real interest rate levels will remain low for the foreseeable future. Two recent earthquakes have threatened an economy that is already in trouble (projected GDP growth in 2011 is only 1.3%). Over the next 12 months, the markets have priced in only 50 basis points in rate hikes. “Nothing here will change the RBNZ’s intentions to keep monetary policy at ‘emergency’ levels for the rest of this year,” summarized one analyst. Meanwhile, the CPI rate is currently at 4.5%, and is generally tracking commodities prices higher.

The other source of strength is the perception that the Kiwi is a commodity currency. To be fair, the production and export of agricultural products (dairy, meat, wool, etc.) makes a significant contribution to New Zealand’s economy. In addition, the prices for such agricultural staples have been rising faster than prices for imported goods, to the extent that the terms of trade have widened further in New Zealand’s favor. Unfortunately, this is ultimately irrelevant, since the aggregate balance of trade is currently in deficit, where it has stood for most of the last decade. If prices for energy and traditional commodities continues to rise, the current account deficit would at risk for eclipsing the record 6% set in 2008.

Sunday, April 24, 2011

How to Choose The Right Forex Broker

Types of Forex Accounts

Best Method of Deposit

Trading Through Computer

Learn Some Market Rules

People who liked this Post also read

- Mini Forex Accounts

Mini forex accounts are great tools for new forex traders to start forex trading business. There are no hard and fast rules about cash to open mini forex accounts. Due to this quality, even individuals having low cash can start forex trading with these ac... - Forex Trading Potential for Beginners

With the always varying prices and exchange rates, Forex Trading is gaining its popularity and deserving limelight. This lucrative business is a lifetime investment which can be initiated from anywhere in the world, let it be home or office. It’s perpetua... - Forex Margin Call : Basics

Margin Call is a situation which arises when you are running low on funds in your accounts. Your broker at this situation would get in touch and would ask you to increase your balance so that you can further pile up on stock. The situation for being on a ... - Forex Reviews

Forex trade is the best selection for traders, particularly for the new ones to develop their trade while having the profits at the end. They can have all the comforts of business since Forex trade comes with a lot of benefits.... - Foreign Exchange Spreads

Spread is an important but complicated parameter in forex trading industry that determines your ability to generate real profits. It is very important to understand forex spreads before working in in this industry....

Icelandic Kronur: Lessons from a Failed Carry Trade

At its peak, nominal GDP was a relatively modest $20 Billion, sandwiched between Nepal and Turkmenistan in the global GDP rankings. Its population is only 300,000, its current account has been mired in persistent deficit, and its Central Bank boasts a mere $8 Billion in foreign exchange reserves. That being the case, why did investors flock to Iceland and not Turkmenistan?

The short answer to that question is interest rates. As I said, Iceland’s benchmark interest rate exceeded 18% at its peak. There are plenty of countries that offered similarly high interest rates, but Iceland was somehow perceived as being more stable. While it didn’t join the European Union until last year, Iceland has always benefited from its association with Europe in general, and Scandinavia in particular. Thanks to per capita GDP of $38,000 per person, its reputation as a stable, advanced economy was not unwarranted.

On the other hand, Iceland has always struggled with high inflation, which means its interest rates were never very high in real terms. In addition, the deregulation of its financial sector opened the door for its banks to take huge risks with deposits. Basically, depositors – many from outside the country – parked their savings in Icelandic banks, which turned around and invested the money in high-yield / high-risk ventures. When the credit crisis struck, its banks were quickly wiped out, and the government chose not to follow in the footsteps of other governments and bail them out.

Moreover, it doesn’t look like Iceland will regain its luster any time soon. Its economy has shrunk by 40% over the last two years, and one prominent economist has estimated that it will take 7-10 years for it to fully recover. Unemployment and inflation remain high even though interest rates have been cut to 4.25% – a record low. The Kronur has lost 50% of its value against the Dollar and the Euro, the stock market has been decimated, and the recent decision to not remunerate Dutch and British insurance companies that lost money in Iceland’s crash will only serve to further spook foreign investors. In short, while the Kronur will probably recover some of its value over the next few years (aided by the possibility of joining the Euro), it probably won’t find itself on the radar screens of carry traders anytime soon.

Now that the carry trade is making a comeback, it’s probably a good time to take a step back and re-assess the risks of such a strategy. Even if Iceland proves to be an extreme case – since most countries won’t let their banks fail – traders must still acknowledge the possibility of massive currency depreciation. In other words, even if the deposits themselves are guaranteed, there is an ever-present risk that converting that deposit back into one’s home currency will result in losses. That’s especially true for a currency that is as illiquid as the Kronur (so illiquid that it took me a while to even find a reliable quote!), and is susceptible to liquidity crunches and short squeezes.

Now that the carry trade is making a comeback, it’s probably a good time to take a step back and re-assess the risks of such a strategy. Even if Iceland proves to be an extreme case – since most countries won’t let their banks fail – traders must still acknowledge the possibility of massive currency depreciation. In other words, even if the deposits themselves are guaranteed, there is an ever-present risk that converting that deposit back into one’s home currency will result in losses. That’s especially true for a currency that is as illiquid as the Kronur (so illiquid that it took me a while to even find a reliable quote!), and is susceptible to liquidity crunches and short squeezes.Forex Win to Loss Ratios

Better to Work with a Systematic Approach

Good Trading System

How Profitability of System can be Determined?

Forex System with High Win/Loss Ratio

What is PIP?

Risk Multiple Principal

People who liked this Post also read

- Low Budget Forex Trading Guide

The principle of low minimum investment has made Forex trading market very popular worldwide. People with small investment amount US$50 can also venture into it. Though you can join the Forex trading business with tight budget, but there are certain limit... - Forex Scalping Methods Explained

Forex scalping method is one of the most popular methods used in Forex trading. In the Forex scalping method of trading is for relatively short period of time. The investors also take profit after a little move in the markets. The scalpers are also the ma... - Foreign Exchange Spreads

Spread is an important but complicated parameter in forex trading industry that determines your ability to generate real profits. It is very important to understand forex spreads before working in in this industry.... - What a Beginner Should Do In Forex Trading?

Forex market is a highly volatile market that is complicated for beginner forex traders. Beginners can attain stable success in this field by working with useful strategies and skills. They have to be consistent and work hard to achieve firm position in f... - What Are the Best Times to Trade the US Dollar?

The US is the world's second biggest forex trading center. The best time to trade the USD is when the US session is in progress. You have to take care of certain things while trading in the US session whether you are working on long or short term basis....

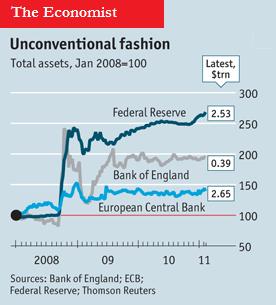

Forex Markets Focus on Central Banks

The currency wars may have subsided, but they haven’t ended. On both a paired and trade-weighted basis, the Dollar is declining rapidly. As a result, emerging market Central Banks are still doing everything they can to protect their respective currencies from rapid appreciation. As I’ve written in earlier posts, most Latin American and Asian Central Banks have already announced targeted strategies, and many intervene in forex markets on a daily basis. If the Japanese Yen continues to appreciate, you can bet the Bank of Japan (perhaps aided by the G7) will quickly jump back in.

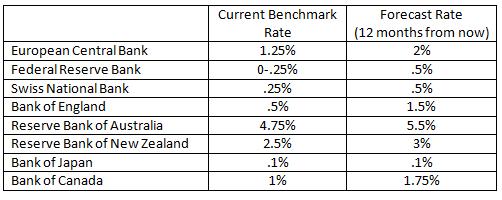

Then there are the prospective rate hikes, cascading across the world. Last week, the European Central Bank became the first in the G4 to hike rates (though market rates have hardly budged). The Reserve Bank of Australia, however, was the first of the majors to hike rates. Since October 2009, it has raised its benchmark by 175 basis points; its 4.75% cash rate is easily the highest in the industrialized world. The Bank of Canada started hiking in June 2010, but has kept its benchmark on hold at 1% since September. The Reserve Bank of New Zealand lowered its benchmark to a record low 2.5% as a result of serious earthquakes and economic weakness.

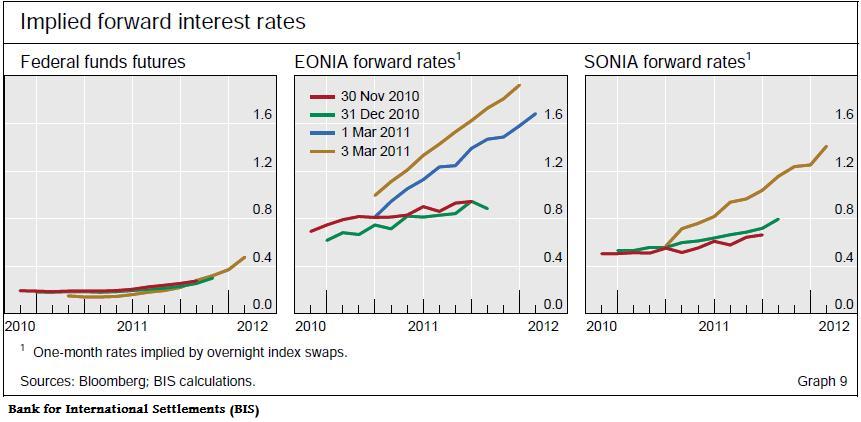

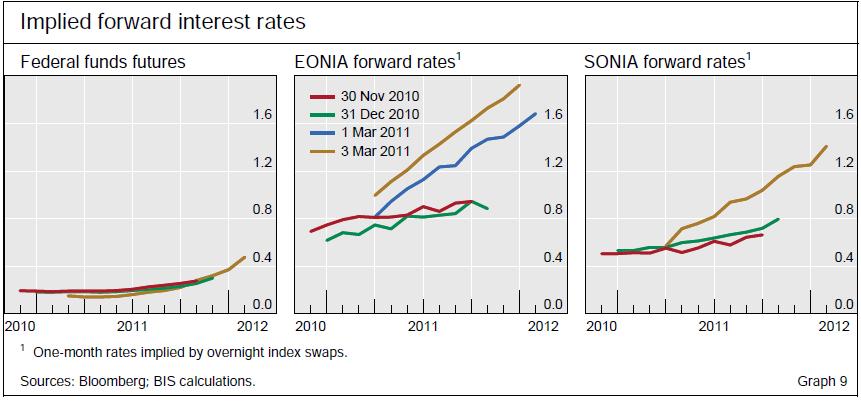

Going forward, expectations are for all Central Banks to continue (or begin) hiking rates at a gradual pace over the next couple years. If forecasts prove to be accurate, the US Federal Funds Rate will stand around .5% at the beginning of 2012, tied with Switzerland, and ahead of only Japan. The UK Rate will stand slightly above 1%, while the Eurozone and Canadian benchmarks will be closer to 2%. The RBA cash rate should exceed 5%. Rates in emerging markets will probably be even higher, as all four BRIC countries (Russia, Brazil, China, India) should be well into the tightening cycles.

On the one hand, there is reason to believe that the pace of rate hikes will be slower than expected. Economic growth remains tepid across the industrialized world, and Central Banks are wary about spooking their economies with premature rate hikes. Besides, Fed watchers may have learned a lesson as a result of a brief bout of over-excitement in 2010 that ultimately led to nothing. The Economist has reported that, “Markets habitually assign too much weight to the hawks, however. The real power at the Fed rests with its leaders…At present they are sanguine about inflation and worried about unemployment, which means a rate rise this year is unlikely.” Even the ECB disappointed traders by (deliberately) adopting a soft stance in the press release that accompanied its recent rate hike.

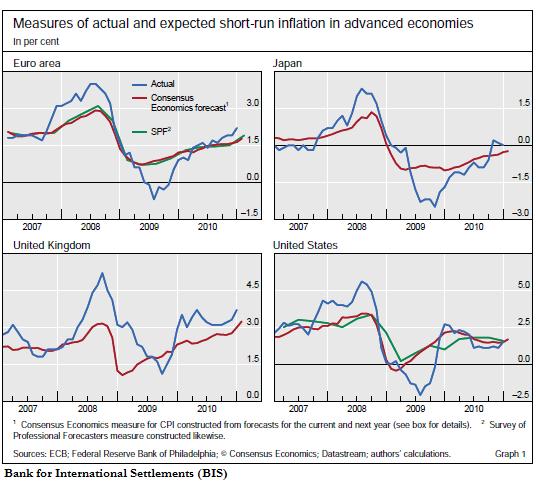

On the other hand, a recent paper published by the Bank for International Settlements (BIS) showed that the markets’ track record of forecasting inflation is weak. As you can see from the chart below, they tend to reflect the general trend in inflation, but underestimate when the direction changes suddenly. (This is perhaps similar to the “fat-tail” problem, whereby extreme aberrations in asset price returns are poorly accounted for in financial models). If you apply this to the current economic environment, it suggests that inflation will probably be much higher-than-expected, and Central Banks will be forced to compensate by hiking rates a faster pace.

Finally, in their newfound roles as economic policymakers, Central Banks are increasingly engaged in macroprudential policy. The Economist reports that, “Central banks and regulators in emerging economies have already imposed a host of measures to cool property prices and capital inflows.” These measures are worth watching because their chief aim is to indirectly reduce inflation. If they are successful, it will limit the need for interest rate hikes and reduce upward pressure on their currencies.

Finally, in their newfound roles as economic policymakers, Central Banks are increasingly engaged in macroprudential policy. The Economist reports that, “Central banks and regulators in emerging economies have already imposed a host of measures to cool property prices and capital inflows.” These measures are worth watching because their chief aim is to indirectly reduce inflation. If they are successful, it will limit the need for interest rate hikes and reduce upward pressure on their currencies.In short, given the enhanced ability of Central Banks to dictate exchange rates, traders with long-term outlooks may need to adjust their strategies accordingly. That means not only knowing who is expected to raise interest rates – as well as when and by how much – but also monitoring the use of their other tools, such as balance sheet expansion, efforts to cool asset price bubbles, and deliberate manipulation of exchange rates.

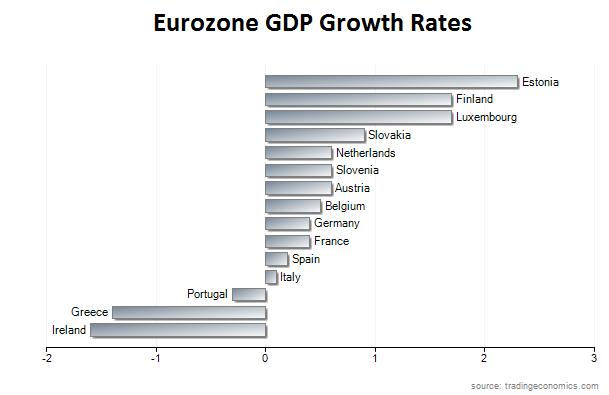

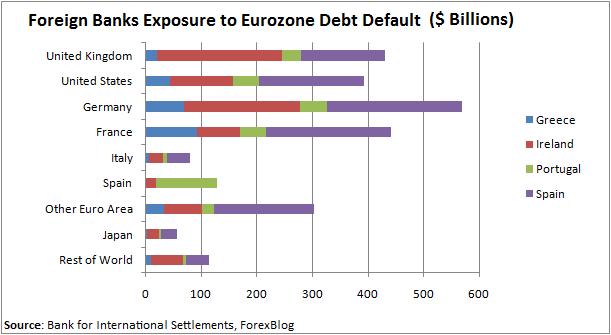

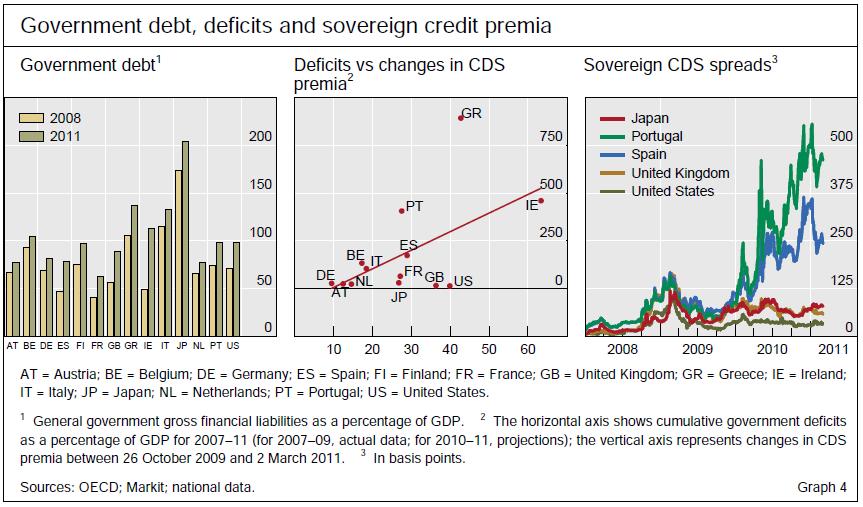

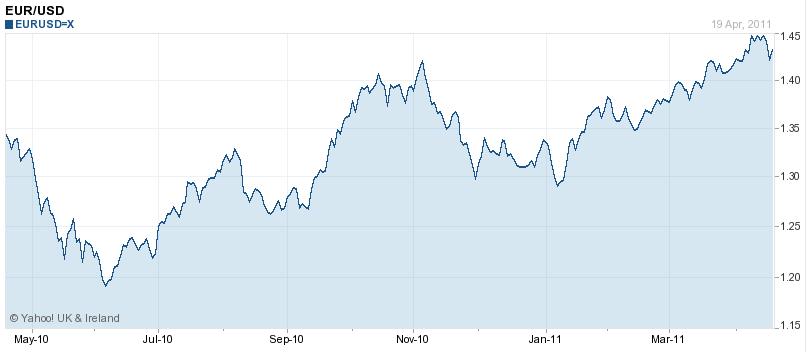

Time to Short the Euro

There’s very little mystery as to why the Euro is appreciating. In two words: interest rates. Last week, the European Central Bank (ECB) became the first G4 Central Bank to hike its benchmark interest rate. Moreover, it’s expected to raise rates by an additional 100 basis points over the next twelve months. Given that the Bank of England, Bank of Japan, and US Federal Reserve Bank have yet to unwind their respective quantitative easing programs, it’s no wonder that futures markets have priced in a healthy interest rate advantage into the Euro well into 2012.

From where I’m sitting, the ECB rate hike was fundamentally illogical, and perhaps even counterproductive. Granted, the ECB was created to ensure price stability, and its mandate is less nuanced than its counterparts, which are charged also with facilitating employment and GDP growth. Even from this perspective, however, it looks like the ECB jumped the gun. Inflation in the EU is a moderate 2.7%, which is among the lowest in the world. Other Central Banks have taken note of rising inflation, but only the ECB feels compelled enough to preemptively address it. In addition, GDP growth is a paltry .3% across the EU, and is in fact negative in Greece, Ireland, and Portugal. As if the rate hike wasn’t bad enough, all three countries must contend with a hike in their already stratospheric borrowing costs, ironically making default more likely. Talk about not seeing the forest for the trees!

Saturday, April 23, 2011

Trading Forex Like a Pro

The Basics of Forex Trading

There are business centers like New York Stock Exchange, where you have to complete all your transactions within a given time. Forex trading is different from stock exchanges and other business centers, because forex trading is a 24 hours business. The forex market is open 24 hours a day and 6 days a week. The forex market is not centralized and extends to several times zones around the world. The traders do their business with the help of communication systems and other tools such as the internet.

What is the Importance of Currency Trade?

How to Become a Currency Trader

Internet Resources

People who liked this Post also read

- What Are the Best Times to Trade the US Dollar?

The US is the world's second biggest forex trading center. The best time to trade the USD is when the US session is in progress. You have to take care of certain things while trading in the US session whether you are working on long or short term basis.... - Online Currency Trading

In order to start online FOREX trading business, the learning is the basic step. There are brokers, data and demos available for those who want to start their career in this business. The online FOREX trading has its own benefits like its a 24 hour servic... - Benefits of Online Forex Trading

Since its inception in 1994, online Forex trading has not only become widely popular amongst the people across the world, but it has also replaced the conventional method of Forex trading to a larger extent. With the help of online Forex trading, even peo... - Mini Forex Accounts

Mini forex accounts are great tools for new forex traders to start forex trading business. There are no hard and fast rules about cash to open mini forex accounts. Due to this quality, even individuals having low cash can start forex trading with these ac... - A Brief History of Forex Trading

Forex trading is an ever-growing market. It is offering great benefits to its participants. Forex trading has passed through many changes and now it has attained the place of one of the most profitable businesses. It allows small investors to make real pr...

Friday, April 22, 2011

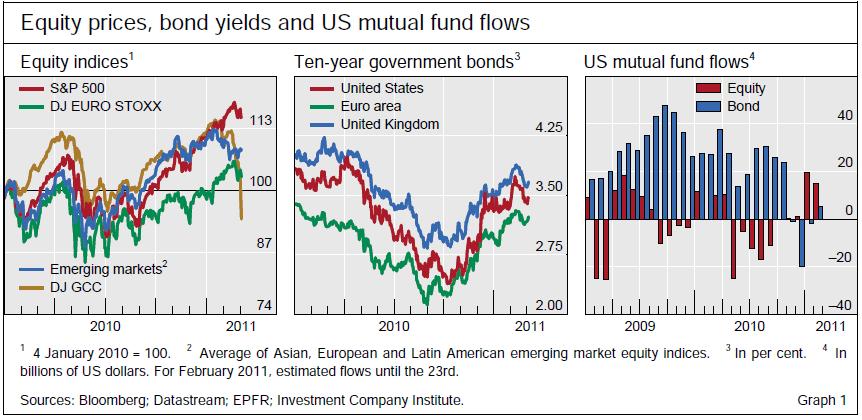

Where are Exchange Rates Headed? Look at the Data

Anyway, the stock market rally that began in 2010 has showed no signs of slowing down in 2011, with the US firmly leading the rest of the world. As is usually the case, this has corresponded with an outflow of cash from bond markets and a steady rise in long-term interest rates. However, emerging market equity and bond returns have started to flag, and as a result, the flow of capital into emerging markets has reversed after a record 2010. Without delving any deeper, the implication is clear: after 2+ years of weakness, developed world economies are now roaring back, while growth in emerging markets might be slowing.

The picture for emerging market economies is slightly less optimistic, however. If you accept the BIS’s use of China, India, and Brazil as representative of emerging markets as a whole, rising interest rates will help them avoid hyperinflation, but significant price inflation is still to be expected. I wonder then if the pickup in cross-border lending over this quarter won’t slow down due to expectations of diminishing real returns.

Thursday, April 21, 2011

The Hunt For The Greatest Forex Signals

If You Are Fascinated In This Enterprise, Listed Below Are A Few Aspects To Consider In Choosing Your Forex Trading Training Course.

You need one specific buying strategy, nevertheless we need some thing that sparks your entry into the currency exchange.

Get a functional product in which a person will pay attention to you when it comes to the advancement of the program. The particular purchase and sale made of those exchange currencies to leverage transfer in value to make money is just what we know as trading currency these days.

If you are interested in this prospect, allow me to share a few factors to consider in choosing your forex trading program.

If you are fresh to the forex trading world and youre interested to venture into this line of work, one of several essential rules that youve to take is to find out everything you can with regards to foreign exchange.

You can either do the research on your own or take a currency trading course that will lead you through the details of producing page profits in the currency market. Trading Currency online is for the majority of people a little bit more challenging then the actual gurus make you imagine.

Robotic Currency trading software program performs its miracles by using complex formula to research the tech signs of foreign currencies to find the currencies that are ready to make a move.

Any relative value of a currency exchange move up and down for diverse reason, part of which will is the substantial sector. Locate a program that is trained by any consultant. This is actually the failing men and women so frequently produce, and the reason why such information may well not always be a persons ally. Youll additionally wish to ensure that the computer software is straightforward to work with and possesses available consumer support.

Due to the fact the Forex market is open up round the clock a day (except on weekends), you should have to leave your computer working non-stop throughout the week to ensure that it can regularly appraise the marketplace and enter and exit trades for you. There exists several studies on basic investing approaches offered on the web, commence there. Come across each website you will be pleasant with, most of them are free and check out them in blend to make an educated selection to execute your trade.

Forex Becomes A Mass Movement

The process involved is basic. If markets are to be efficient, past price movements shouldn’t predict future movements, but this is just one of the conditions. For this scenario the rise in volatility is proportionate to the square root of time, hence the volatility of fortnightly change is the same as the square root of two multiplied by the weekly volatility.

If we test the volatility of actual to random walk, we can see whether a price follows random walk or not. A higher random walk volatility than actual volatility translates into falls in one period leading to rises in the eventual period.

The ratio of actual to random walk volaitility for three main exchange rates can be seen in my chart. The pound may rise for a few weeks but would fall because of reversion is the suggestion here Further your knowledge on foreign exchange at currency conversion calculator.

Nevertheless, the ratios touch one, as close as 12 percent of it. One could easily lose fortunes bettinf on the inefficiency since it is so little. The diminishing profit making became staple of Forex trading in the 1990s since investors started wising up to the momentum effects.

One can see deviations over a short period of time from the random walk. Anticipating surprises better than the market can lead to a person making money even from a random walk. Our data findings show a roughly random rate move for foreign exchange over a 17 year period. The efficiency of a market would be brought down in extremely short periods.

For traders, knowing news like the US dollar turning absolutlely worthless in an years time would be priceless. It would have been possible to make money by purchasing the dollar at its lower point because it over reacted and then mean reverted.

But this is not an inefficient market. The profits made from purchasing dollar at its low point aren’t risk free ones but instead a reward for taking the crash risk. The predominant character in exchange rates over the years is the variation in crash risk.

It is obvious that the message is plain. It is but obvious that banks can do this because of their advantages over ordinary retail investors. Since banks have proprietary information about the FX orders placed by a client they can successfully predict the flow of the market. Trading costs are virtually zero for banks, this makes it profitable for them since their hoover is cheaper now. Trading in Foreign Exchange is safe only if one is aware of these edges.

Wednesday, April 20, 2011

Fed Mulls End to Easy Money

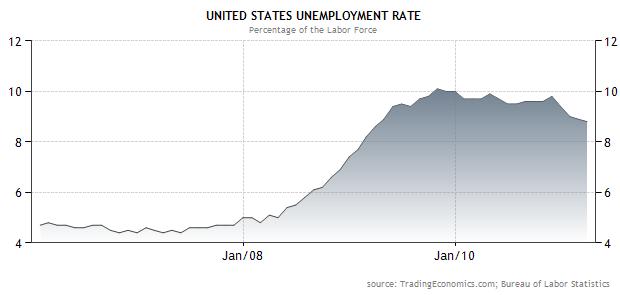

First of all, the economic recovery is gathering momentum. According to a Bloomberg News poll, “The US economy is forecast to expand at a 3.4 percent rate this quarter and 3.3 percent rate in the second quarter.” More importantly, the unemployment rate has finally begun to tick down, and recently touched an 18-month low. While it’s not clear whether this represents a bona fide increase in employment or merely job-hunting fatigue among the unemployed, it nonetheless will directly feed into the Fed’s decision-making process.

In fact, the Fed made such an observation in its March 15 FOMC monetary policy statement, though it prefaced this with a warning about the weak housing market. Similarly, it noted that a stronger economy combined with rising commodity prices could feed into inflation, but this too, it tempered with the dovish remark that “measures of underlying inflation continue to be somewhat low.” As such, it warned of “exceptionally low levels for the federal funds rate for an extended period.”

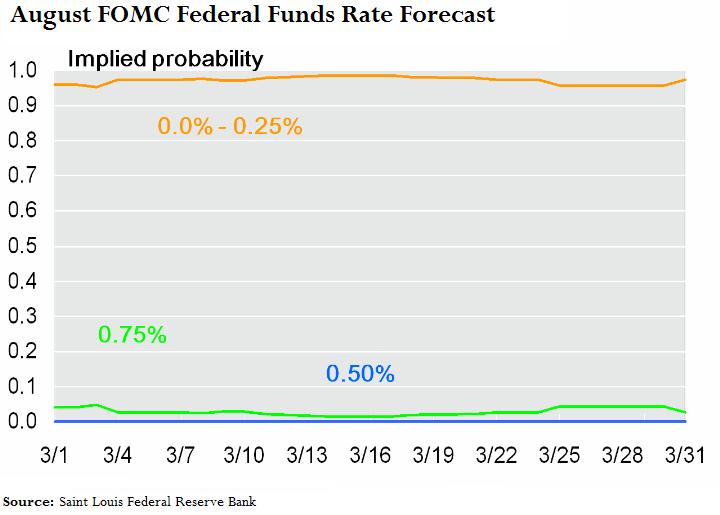

To be sure, interest rate futures reflect a 0% likelihood of any rate hikes in the next 6 months. In fact, there is a 33% chance that the Fed will hike before the end of the year, and only a 75% chance of a 25 basis point rise in January of 2012. On the other hand, some of the Fed Governors are starting to take more hawkish positions in the media about the prospect of rate hikes: “Minneapolis Federal Reserve President Narayana Kocherlakota said rates should rise by up to 75 basis points by year-end if core inflation and economic growth picked up as he expected.” Given that he is a voting member of the FOMC, this should not be written off as idle talk.

Meanwhile, Saint Louis Fed President James Bullard has urged the Fed to end its QE2 program, and he isn’t alone. “Philadelphia Fed President Charles Plosner and Richmond Fed President Jeffrey Lacker have also urged a review of the purchases in light of a strengthening economy and concern over future inflation.” While the FOMC voted in March to “maintain its existing policy of reinvesting principal payments from its securities holdings and…purchase $600 billion of longer-term Treasury securities by the end of the second quarter of 2011,” it has yet to reiterate this position in light of these recent comments to the contrary, and investors have taken notice.

Assumptions will probably be revised further following tomorrow’s release of the minutes from the March meeting, though investors will probably have to wait until April 27 for any substantive developments. The FOMC statement from that meeting will be scrutinized closely for any subtle tweaks in wording.

Ultimately, the take-away from all of this is that this record period of easy money will soon come to an end. Whether this year or the next, the Fed is finally going to put some monetary muscle behind the Dollar.